The real estate market is a dynamic and cyclical environment that can significantly impact the decisions of both buyers and sellers. Understanding these market cycles is crucial for making informed decisions whether you’re looking to purchase a home or sell one. This comprehensive guide explores real estate market cycles, their phases, and what buyers and sellers need to know to navigate them successfully.

What Are Real Estate Market Cycles?

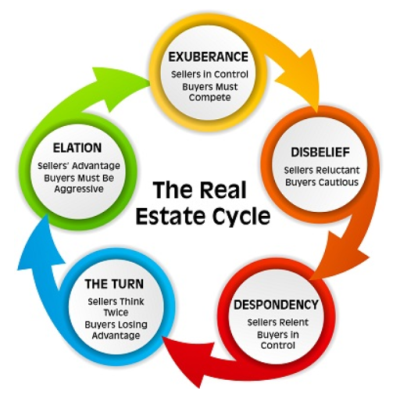

Real estate market cycles refer to the predictable phases of growth and decline that characterize the housing market over time. These cycles are influenced by various economic factors, including interest rates, employment levels, and economic growth. Understanding these cycles helps buyers and sellers anticipate market trends and make strategic decisions.

Phases of Real Estate Market Cycles

Real estate market cycles typically consist of four distinct phases: recovery, expansion, hyper-supply, and recession. Each phase has its characteristics and implications for buyers and sellers.

- Recovery

The recovery phase follows a market downturn or recession. During this period, economic conditions begin to improve, and the real estate market starts to show signs of stabilization. Property values may still be relatively low, but there is a gradual increase in demand.- Characteristics: Increased buyer activity, rising property prices, and lower inventory levels.

- Opportunities for Buyers: This phase offers potential bargains as prices start to recover. Buyers should be prepared to act quickly as competition increases.

- Opportunities for Sellers: Sellers may start to see more interest in their properties, but it’s essential to price homes competitively to attract buyers.

- Expansion

The expansion phase is characterized by a robust economy and strong demand for real estate. Property values increase steadily, and new construction projects become more common. This phase is marked by a seller’s market where demand outstrips supply.- Characteristics: Rising property prices, high demand, and increased construction activity.

- Opportunities for Buyers: Buyers may face higher prices and increased competition. It’s important to have pre-approved financing and be prepared to make competitive offers.

- Opportunities for Sellers: Sellers can benefit from high property values and strong demand. Homes tend to sell quickly, often at or above the asking price.

- Hyper-Supply

The hyper-supply phase occurs when the market becomes saturated with properties. During this period, the rate of new construction exceeds demand, leading to an oversupply of homes. Property values may start to plateau or decline.- Characteristics: Excess inventory, longer time on the market, and decreasing property values.

- Opportunities for Buyers: Buyers have more options and may find better deals as sellers become more motivated. It’s a good time to negotiate on price and terms.

- Opportunities for Sellers: Sellers may face challenges in achieving their desired price. It’s important to make properties stand out through staging and competitive pricing.

- Recession

The recession phase is marked by a downturn in the real estate market, often due to economic factors like high unemployment or rising interest rates. Property values decline, and sales activity slows down.- Characteristics: Falling property values, reduced demand, and increased foreclosures.

- Opportunities for Buyers: Buyers may find lower prices and increased leverage. It’s a good time to buy if you can afford it and are willing to hold onto the property until the market recovers.

- Opportunities for Sellers: Selling during a recession can be challenging. Sellers may need to adjust their expectations and price properties competitively to attract buyers.

How Economic Factors Influence Real Estate Cycles

Several economic factors influence real estate market cycles:

- Interest Rates

Interest rates have a significant impact on real estate cycles. Low interest rates can stimulate demand by making borrowing cheaper, leading to a rise in property values. Conversely, high interest rates can dampen demand and lead to a slowdown in the market. - Employment Levels

Employment levels affect buyer confidence and purchasing power. High employment rates generally lead to higher demand for housing, while high unemployment can reduce demand and impact property values. - Economic Growth

Economic growth drives demand for real estate by increasing consumer confidence and spending power. During periods of economic expansion, people are more likely to invest in real estate, contributing to rising property values. - Supply and Demand

The balance between housing supply and demand is a key factor in market cycles. An imbalance, whether due to excessive new construction or a shortage of inventory, can lead to fluctuations in property values and market conditions.

Strategies for Buyers and Sellers in Different Market Phases

Understanding market cycles allows buyers and sellers to adopt strategies tailored to the current phase of the cycle:

- In a Recovery Phase

- For Buyers: Look for properties in emerging neighborhoods with growth potential. Be prepared to move quickly and negotiate effectively as competition increases.

- For Sellers: Price your home competitively and be prepared for an increase in buyer activity. Focus on making your home appealing to potential buyers.

- In an Expansion Phase

- For Buyers: Act swiftly and be ready to make competitive offers. Consider locking in a mortgage rate if interest rates are rising.

- For Sellers: Take advantage of high property values and strong demand. Ensure your home is in excellent condition to attract buyers and maximize your sale price.

- In a Hyper-Supply Phase

- For Buyers: Explore a wide range of properties and take your time to find the best deal. Use the oversupply to negotiate favorable terms and prices.

- For Sellers: Be prepared for longer selling times and potential price reductions. Enhance your property’s appeal through staging and pricing strategies.

- In a Recession Phase

- For Buyers: Look for bargains and be patient. Use the opportunity to purchase at lower prices, but be prepared for a potentially slower market.

- For Sellers: Adjust your expectations and price your property competitively. Consider offering incentives to attract buyers and make your property stand out.

How to Stay Informed About Market Cycles

To make informed decisions, it’s essential to stay updated on real estate market trends:

- Monitor Market Reports

Regularly review market reports and analyses from real estate agencies, economic forecasts, and industry publications. These reports provide insights into current market conditions and future trends. - Consult Real Estate Professionals

Work with experienced real estate agents and brokers who have a deep understanding of local market conditions. They can offer valuable advice and help you navigate the market based on current cycles. - Attend Industry Seminars and Workshops

Participate in real estate seminars, workshops, and webinars to stay informed about market trends and strategies. These events often feature expert speakers and provide valuable networking opportunities. - Follow Economic Indicators

Keep an eye on economic indicators such as interest rates, employment data, and GDP growth. These indicators can help you anticipate changes in the real estate market and make strategic decisions.

Conclusion

Understanding real estate market cycles is crucial for both buyers and sellers looking to navigate the housing market successfully. By recognizing the phases of the market cycle—recovery, expansion, hyper-supply, and recession—you can make informed decisions and adopt strategies that align with current market conditions. Staying informed about economic factors and market trends will help you capitalize on opportunities and mitigate risks. Whether you’re buying your first home or selling an investment property, a solid grasp of market cycles will enable you to make more strategic and effective real estate decisions.